On why we shouldn’t fear the flip and other successful heresies from Art Basel 2019

It is no surprise that gallery booths at Art Basel are filled with works by artists who performed well in recent evening auctions. What is surprising however is the quick flipping of works by some galleries – a practice that is generally looked down upon by the industry.

When Pace Gallery’s president, Marc Glimcher, declared to ARTNEWS[1] that his gallery has sold 70% of its booth only 4 hours after Art Basel’s doors opened for the VIP First Choice Pass holders, he was at least partially referring to a Calder sculpture sold for $8.5 million which was just been auctioned for $3.9 million at Christie’s New York in November 2017. This was not an isolated case. Helly Nahmad Gallery flipped yet another Calder mobile titled Red Sumac for $5.8 million, which was even more recently sold for $4.1 million at Sotheby’s in November of 2018.

This begs the question, how can a Calder mobile appreciate in value by more than 50% in less than 1 year? What effect do the almost Machiavellian actions of megadealers in the 50th edition of Art Basel have on the art market?

The case of the two flipped Calders bucks two standard rules of thumb for experienced market players. The first is that the growth of online auction databases should provide a Fair Market Value comp set for collectors, thus stabilizing prices, making it harder to flip them for big profits. Second, a work’s ‘freshness’ to market (or rarity) is one of the biggest motivations for buyers to make large investments in a piece. But the examples cited previously break this archetype. This effect can be adjudicated for various reasons:

- Buyers have fear of missing out. Dealers are experienced in provoking a sense of anxiety in certain buyers, particularly in inexperienced ones, to encourage them to impulsively rush their acquisition decisions with the aim of securing trophy pieces. Impressionable collectors are easily dazzled by the seller’s rhetoric and auction records headlines. Such is the case of Gagosian’s motivation behind bringing to Basel 2019 a $25 million USD Peter Doig. Just 15 months after Doig’s “The Architect’s Home in the Ravine” fetched $20 million at Sotheby’s, the landscape is back on the market.[2] It sold twice for the world record for the artist and it is believed that it would set the record for the third time.’’ This “trophy piece” has been offered at auction five times since 2002, achieving to attract headlines every time it appears on the market. Free worldwide publicity could be a great motivation to buy a piece, but in Artemundi, we focus on the quality and the returns, avoiding speculative vogues. Thus, we are disciplined in our acquisition due diligence process. Although our examination protocol takes its time, it allows us to act on business opportunities with a thoughtful perspective.

- Limited supply and consistent demand is forcing galleries to get creative with their sales strategies. The pre-sold booths[3] and the private viewing rooms for off-the-floor trade are reserved for exclusive use by high-profile buyers and therefore limit the supply as well as the access to museum-quality artworks in the upper-end market. The required level of connoisseurship is a significant barrier to entry associated to the art market, but more significantly is the requires high-capital commitments. This creates a near oligopoly market in which the fast-growing pool of UHNWI’s are confronted with a limited supply of masterworks forcing buyers to compete against one another for acquisitions. These space limitations by the private booths force galleries to get creative with other selling techniques to offer apex-market work to hungry collectors. For example, on the opening day of Basel 2019, Hauser & Wirth reported selling 30 works, however these sales numbers included works never technically shown at Art Basel, they were offered to collectors through a catalogue that the gallery published in advance of the fair.[4] Pieces sold via the catalogue include: John Chamberlain’s COMEOVER (2007) for $3 million, Philip Guston’s Boot (1968) for over $2.5 million, Piero Manzoni’s Achrome (1962–63) for €2.6 million ($2.9 million), and Jack Whitten’s Nine Cosmic CDS: For The Firespitter (Jayne Cortez) (2013) for $2 million.[5]

- Capital market instability is causing a flight to hedge investments. A final possible explanation for the swift resale of recently auctioned artworks could be due to the current macroeconomic instability of the traditional investments. With the bond market’s recent inverse yield curve signaling potential distress in the market, some collectors don’t mind paying overpriced tags of artists who have consistently appreciated and outperformed their peers. From this perspective, some savvy investors are aiming to use art as a hedge against inflation and other economic fluctuations, by selectively acquiring a concentrated number of masterpieces that have shown stable long-term value.In a recessionary atmosphere, it is not unusual to see the offering of quality art available shrink. A recession leads to a contraction in the (uppermost) art market supply and thus to the preservation of works’ value when the owners of top-quality works hold on to their pieces out of emotional attachment, as well as fear of selling too cheap. Therefore, during recessionary atmospheres, it becomes harder for intermediaries to find pieces for sale; particularly in the “A+” segment, where the appetite of sophisticated buyers remains strong throughout the various market cycles.

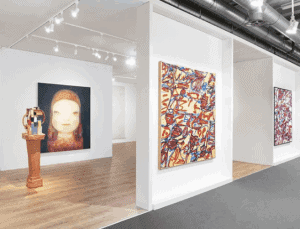

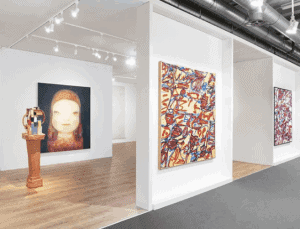

At Art Basel 2019, David Zwirner’s sales of blue-chip works included a 1966 painting by Gerhard Richter for $20 million. This Gallery also parted with, Kerry James Marshall’s Laundry Man (2019) for $3.5 million, and a large 1967 painting by Joan Mitchell for more than $6 million, which overall, signaled that buyers are looking for consolidated works.[6] Zwirner’s further success with its off-site sales includes a Yayoi Kusama’s Pumpkin (2015) for $2 million and a Donald Judd stack from 1991 for $900,000 presold from its online portal. This further indicates that there is a glut of buyers looking to move capital into market-tested works.[7] In Artemundi, we avoid investing in these ‘speculated artists’; instead, we focus on investing in consolidated “blue-chip” artists whose prices have proved to transcend trends and temporary influxes.

The art fair model has mutated since its origins in 1970 when Ernst Beyeler, a dealer and collector, and gallerists Trudl Bruckner and Balz Hilt, started out Art Basel as an experimental initiative. In its first two decades, visitors could still be surprised by impromptu interventions of activists and performing artists on the fair’s sidelines.

By the 1990s, the fair had consolidated as a privileged venue for gallerists and the moneyed mainstream collectors prompting smaller and younger galleries to band together to create some off-site spaces around the exhibition grounds, projects that would later become the like Liste & Volta fairs. Now, after 20 years, these satellite fairs are also part of the market establishment.

Whatever sales strategies were used by the galleries to tempt their clients into expanding their collections Art Basel’s results this year are striking. They signal a strengthening at the top-level of the art market, and further secure Basel’s position as the world’s art mecca.

More examples of Art Basel 2019 sales below:

Richard Gray’s booth sold an Alex Katz painting, Summer Triptych (1985), for $1.7 million, surpassing Katz’s auction record of $1.2 million.[8]

Lévy Gorvy sold, for around $5 million, a 2014 Mark Grotjahn painting, Untitled (Indian #2 Face 45.47).

[1] Douglas, Sarah. “Jeff Koons’s ‘Sacred Heart’ and a Bevy of Alexander Calders Star in 50th Edition of Art Basel Fair, With Early Sales Solid -.” ARTnews, 12 June 2019, www.artnews.com/2019/06/11/art-basel-2019-sales-report/.

[2] Kazakina, Katya. “What Happens When You Unexpectedly Buy That $20 Million Painting.” Bloomberg.com, Bloomberg, 12 June 2019, www.bloomberg.com/news/articles/2019-06-12/what-happens-when-you-unexpectedly-buy-that-20-million-painting.

[3] Artemundi, “What Art Basel is hiding from you“, 13 June 2019.

[4] Douglas, Sarah. “Jeff Koons’s ‘Sacred Heart’ and a Bevy of Alexander Calders Star in 50th Edition of Art Basel Fair, With Early Sales Solid -.” ARTnews, 12 June 2019, www.artnews.com/2019/06/11/art-basel-2019-sales-report/.

[5] Freeman, Nate. “In Basel, Galleries Look beyond Fair Booths to Close Big Sales.” Artsy, 11 June 2019, www.artsy.net/article/artsy-editorial-art-basel-basel-galleries-fair-booths-close-big-sales-06-11-19.

[6] Douglas, Sarah. “Jeff Koons’s ‘Sacred Heart’ and a Bevy of Alexander Calders Star in 50th Edition of Art Basel Fair, With Early Sales Solid -.” ARTnews, 12 June 2019, www.artnews.com/2019/06/11/art-basel-2019-sales-report/.

[7] Freeman, Nate. “In Basel, Galleries Look beyond Fair Booths to Close Big Sales.” Artsy, 11 June 2019, www.artsy.net/article/artsy-editorial-art-basel-basel-galleries-fair-booths-close-big-sales-06-11-19.

[8] Douglas, Sarah. “Jeff Koons’s ‘Sacred Heart’ and a Bevy of Alexander Calders Star in 50th Edition of Art Basel Fair, With Early Sales Solid -.” ARTnews, 12 June 2019, www.artnews.com/2019/06/11/art-basel-2019-sales-report/.