The Metamorphosis of the Art Market: New KYC and Due Diligence Legislations

A recent report by a US Senate Permanent Subcommittee on Investigations declared, in a rather damming fashion, that the international art market is “the largest, legal, unregulated industry in the United States.” [1] This manipulation of the art market and secret deals may seem right in some cases; however, the Artemundi team strives to upkeep and promote a transparent business practice that diffuses this statement. As Congress returns after its August recess, there is even more renewed pressure to pass anti-money laundering legislation that we consider paramount and has languished over the past years.

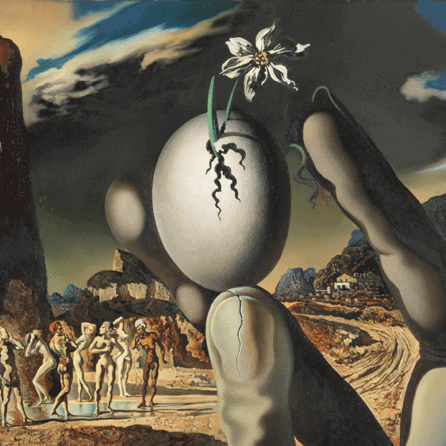

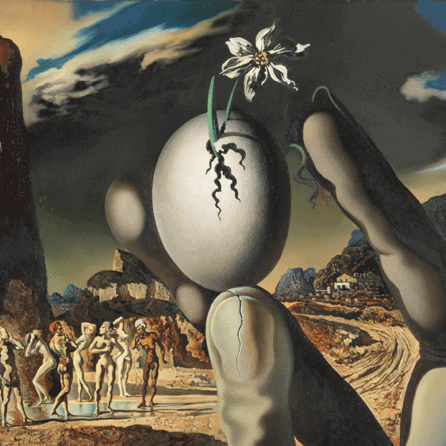

In July, a report released exposes the market manipulation carried out by the Russian construction billionaire brothers Arkady and Boris Rotenberg in 2014.[2] The duo illegally spent more than USD 18M on art in the US, buying at least nine works purchased through shell companies and auction houses. Several of the acquisitions were performed during Sotheby’s New York Impressionist and Modern Art Day Sales, and a USD 7.5M René Magritte’s 1961 painting “Chest” was acquired privately through a US dealer. [3]

But what is being done to stop these shady deals? How can the art market fight back?

We have been pioneers in the introduction of KYC and AML protocols. Commonly criticized for being “too strict or cold-blooded” in our measures, we instead focus on safeguarding all transactions and ensure our sellers, buyers, and investors the confidence they need. Our transparency practice has been adopted since our foundation over 30 years ago. And now, we are proud to witness a more significant change in the art market regulation. Most recently, North America’s House of Representatives, whose office passed the law HR 2514 in fall 2019. This law requires, among other things, “a person trading or acting as an intermediary in the trade of art” to establish a mandatory anti-money laundering program. This new requirement also applies to any advisor[s], consultant[s], or any other person who engages as a business in soliciting the sale.[4] When applied correctly, these rules should create transparency while ensuring client confidentiality – the trickiest balancing act for art market professionals.[5]

Deborah Lehr, the chairman, and co-founder of the Washington, DC-based Antiquities Coalition, in an opinion piece for The Hill, says, “The [report] and its troubling revelations make clear that a push may be needed, lest some continue to hide behind voluntary guidelines to avoid their professional responsibilities. We thus ask Congress to finish this charge.”[6]

While some mandatory initiatives such as UK & EU’s “KYC” anti-money laundering legislation obliges the disclosure of the parties involved, there is still a long way to go. Centuries of stealth dealership and secrecy deals need time to materialize a tangible change. However, we are witnessing a wider acceptance and implementation of these compliance measures by professional art market players. Moreover, the development of tools such as ARTAML [7], a specialized digital platform design to fulfil anti-money laundering checks for art transactions, has just launched its beta edition, starting a journey that will forever change customer due-diligence checks in the art market.

At Artemundi, transparency underlies every aspect of our business. We believe transparency and due diligence are critical to safeguarding transactions’ integrity and maintain our commitment to comply with the highest industry and international guidelines.

[1] Carrigan, M. Will US Congress finally pass anti-money laundering legislation? London: The Art Newspaper. August, 26 2020. Retrieved September 15, 2020, from https://www.theartnewspaper.com/news/secretive-market-enables-sanctions-circumvention

[2] Ludel, W. Senate investigation finds art market secrecy allowed Russian billionaire brothers, friends of Putin, to evade government sanctions. London: The Art Newspaper. August 04, 2020. Retrieved September 16, 2020, from https://www.theartnewspaper.com/news/senate-investigation-finds-art-market-secrecy-allowed-russian-billionaire-brothers-and-friends-of-putin-to-evade-government-sanctions

[3] Carrigan, M. (Will US Congress finally pass anti-money laundering legislation? London: The Art Newspaper. August, 26 2020. Retrieved September 16, 2020, from https://www.theartnewspaper.com/news/secretive-market-enables-sanctions-circumvention

[4] Lumbreras, J. Coyote Carnage: The End of Scavenger Dealers. February 21, 2020. Retrieved September 16, 2020, from https://www.artemundi.com/coyote-carnage-the-end-of-scavenger-dealers/

[5] Wilson, Martin. Art Law and the Business of Art. , 2019. Internet resource. https://www.elgaronline.com/view/9781788979870/chapter09.xhtml

[6] Ibid.